defer capital gains tax australia

Invest in a securities firm for at least one year and invest in the same stock firm for at least three years then reduce the amount of capital gains tax by 10 and 15. A Australia does not have any system where you can defer CGT by rolling the profit into another investment.

Doing Business In The United States Federal Tax Issues Pwc

What Is Tax-Deferred Income In Australia.

. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. An increase in value may occur either when you roll it over or when you defer itIn general when filing your taxes you have the choice of whether to submit it or notConsider extending the duration of your grant. Deferring Those Capital Gains Taxes Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange.

The Deferred Sales Trust DST offers an attractive and flexible tax. Those who are individuals pay the same rate as their income tax rates. Rather it is deferred into another property.

Owners of highly appreciated assets are often highly reluctant to sell because of the capital gains taxes that are typically due upon closing. There are only limited opportunities to defer capital gains tax. Defer all capital gains for eight years if the profits are reinvested and held in an Opportunity Zone.

However the Tax Cut and Jobs Act TCJA which took effect on Jan. 04 Aug 2021 QC 66018. To defer taxation on income or gains relating to.

How Much Tax Do I Pay On Capital Gains In Australia. Deferral Of Capital Gains Via Reinvestment. Fortunately the system does give you a 50 per cent discount on the tax payable if you.

For example a business can apply for an extension if it needs to replace a rollover asset and has not acquired the asset in the time allowed. By calculating these amounts you. Trust non-assessable payments CGT event E4 Capital gains tax CGT applies to investments in shares in a company units in a managed fund or other unit trust and similar products.

Taxes for SMSFs are 15 with a discount of 33 if you dont file any returns. These arrangements are also known as 1031 exchanges in reference to. How Long Can You Defer Capital Gains Tax.

Unless the property in question is real estate you have to pay capital gains tax on a disposition of a capital asset before reinvesting the proceeds. As a licensed Investment Advisor Enrolled Agent Jesse Lipscomb specializes in Tax Return Based Financial Planning and believes minimizing taxes today can greatly enhance ones wealth tomorrow. If you own the asset for more than twelve months however then youll receive a 50 discount.

Tax-Deferred Exchange Many people refer to this arrangement as a tax-free exchange but capital gains are not actually tax-free. Sometimes you can choose to roll over a capital gain. Decrease the amount of any capital gains tax by 10 and 15 if the investment is held for five and seven years respectively.

Tax returns are typically filed with this choice made. How to avoid capital gains tax on your property. More time may be available to you as part of your extension.

Capital gain if the amount of money and property you received or were entitled to receive from the CGT event was more than the cost base of your. Theyll consider all the options and help you prevent or reduce the amount you are liable to pay including whether you are eligible to claim that the property you are selling is actually your primary residence. The capital gains will eventually be taxed when that property is sold or will be deferred again in another exchange.

It can be either a capital gain if you decide to roll over or defer or vice versa. February 22 2020 1000pm. The 1012 Tax Bracket.

Complete this section if a capital gains tax CGT event happened in 202021. Long story short bought a house that closed on Jan 6 2022 sold mutual funds for the down payment just realized that the funds sale posted 12312021 and the capital gains tax is now due for 2021 rather than 2022. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years.

Can You Defer Capital Gains Tax In Australia. You may have made a capital gain or capital loss. Amounts that are tax-deferred are not assessed such as capital gains indexes and income differences that can be assumed to have been deducted from income.

How much is capital gains tax in Australia. Generally you make your choice in your tax return but you can apply for an extension of time. Defer capital gains tax australia.

The DST can defer capital gains taxes on the sale of almost any type of highly appreciated asset including but not limited to. The primary means of avoiding capital gains tax on the sale of an asset is the like-kind exchange provision under Code section 1031. Although it is referred to as capital gains tax it is.

A graduate of the United States Military Academy at West Point Jesse developed a strategy called Financial. Can You Defer Capital Gains Tax In Australia. Meet Jesse Lipscomb Enrolled Agent.

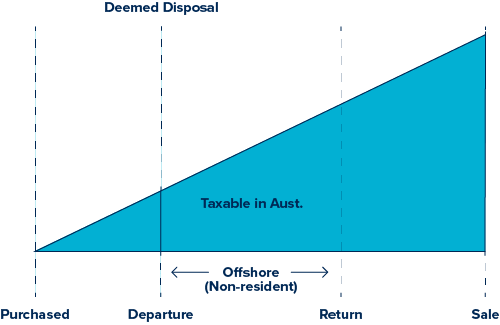

And amid the Reserve Bank of Australias warnings that it is likely to. The 1031 exchange is an excellent tax planning tool when investors wish to defer the payment of any capital gain and depreciation recapture taxes generated from the sale or disposition of real property or personal property by reinvesting in replacement property. This is because Australia treats the cessation of tax residency in Australia as a Capital Gains Tax Event which can give rise to a deemed disposal of an investment where the sale proceeds are taken to be equal to the investments market value at the time that residency in Australia ends.

For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. To get the best possible advice on how to avoid capital gains tax in Australia you should talk to a tax accountant. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the.

1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. A corporation is not entitled to a capital gains tax discount and you will be taxed 30 on capital gains that result from your business. You report capital gains and capital losses in your income tax return and pay tax on your capital gains.

For individuals capital gains tax is calculated at the same rate as your income tax. MyTax 2021 Capital gains or losses. Takeovers and mergers scrip-for-scrip rollover.

For most CGT events you make a. Defer capital gains tax to next year. 04 Aug 2021 QC 66044.

What Is Capital Gains Tax Cgt Everything About Cgt

The Capital Gains Tax And Inflation Econofact

Can You Defer Capital Gains Tax In Australia Ictsd Org

What Is A Deemed Disposal Atlas Wealth Management

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Deferring Capital Gains Tax When Selling Art

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Managing Tax Rate Uncertainty Russell Investments

Can You Defer Capital Gains Tax In Australia Ictsd Org

Capital Gains Tax How It Affects Commercial Property Commercial Loans

How To Legally Avoid Crypto Taxes Koinly

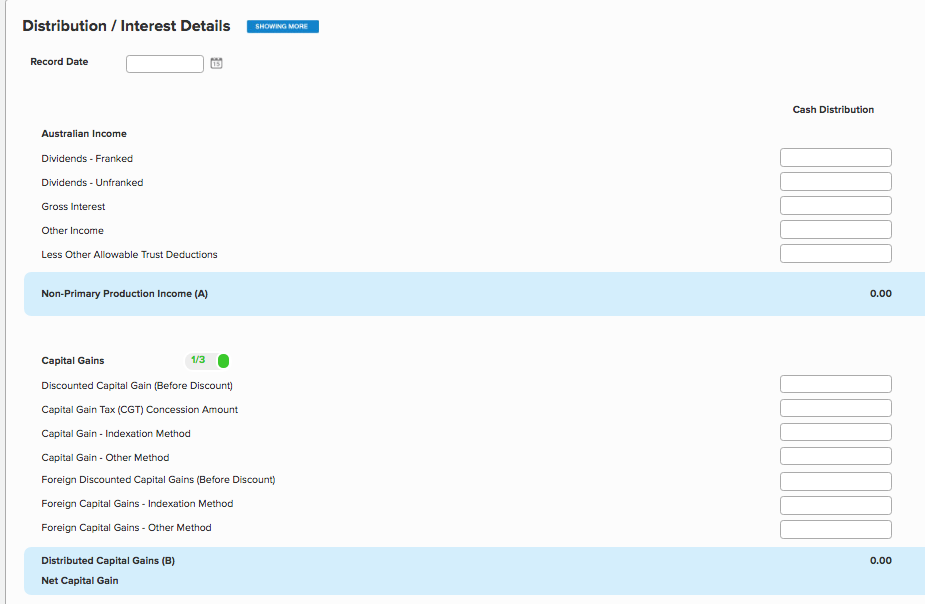

How To Enter A Distribution Tax Statement Simple Fund 360 Knowledge Centre

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

How To Avoid Capital Gains Tax Australia Ictsd Org

How To Reduce Capital Gains Tax Australia Ictsd Org

How To Avoid Capital Gains Tax On Investment Property Australia Ictsd Org

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Calculate Capital Gains Tax On Property Australia Ictsd Org